For the rest we agree, but we must respond with parables to the first truths which are always debited to us "from the same barrel" (with "accountant" arguments follow the dotted line of my gaze ...)

Price inflation since 2000 in France

- Obamot

- Econologue expert

- posts: 28725

- Registration: 22/08/09, 22:38

- Location: regio genevesis

- x 5538

We have recently been forced to return to inflation, we have gone through periods of deflation and a very long period of stagflation. Besides, it is relatively difficult to know in which situation one is exactly.

For the rest we agree, but we must respond with parables to the first truths which are always debited to us "from the same barrel" (with "accountant" arguments follow the dotted line of my gaze ...)

For the rest we agree, but we must respond with parables to the first truths which are always debited to us "from the same barrel" (with "accountant" arguments follow the dotted line of my gaze ...)

0 x

-

Christophe

- Moderator

- posts: 79360

- Registration: 10/02/03, 14:06

- Location: Greenhouse planet

- x 11060

A) Bernardd, I do not understand much about your link, you do not have another clearer?

Here we are talking about consumer products, therefore the INSEE Consumer Price Index = price inflation, do not you think?

BUT the 3 inflations you are talking about are related. "Everything" comes from monetary inflation itself resulting from monetary creation (credit debt, printing money ...) the other 2 are only consequences.

The higher the interest rates, the higher the monetary inflation (and therefore the other 2). Look at the history of 80 years ... interest rates were testing 10% but at the same time people were buying their homes in less than 10 years generally ... almost unthinkable today ...

On the other hand, it is not because a trader raises his prices that he participates in the inflation of the currency, it would be necessary that all do it ... and still not sure that this has lasting consequences. The problem is that a trader rarely drops his prices ... even if the purchase price has dropped. We will soon have a good example in practice with the price of bread, linked to the price of wheat which increases following the Russian fires of the summer. So in the end, as felt by the consumer, it is as if it were monetary inflation.

B) Regarding real estate, if it was really the value of the currency that was falling, then wages and pensions should have increased by the same proportion. Now we have found this recently:

https://www.econologie.com/forums/la-rentree ... tml#177548

Near 100% increase in 10 years what is it? Surely not a consequence of inflation, it is the foutage mouth of the owners (baby boomers for the most ... we find them ...) ... and unconsciousness (stupidity?) on the part of young couples who buy with 30 or 40 years of credit ...

In practice, look around: any owner who has become so before 2000 has earned more money on the real estate speculation of his property than by saving his labor. This is the kind of thing that should please Xaveco ca

If real estate is not taken into account in the calculation of inflation, it is above all so as not to publicly admit double-digit price inflation ... in times of "real estate crisis" as it has been since 2 years...

C) Regarding the evolution of prices since 98, I found this: http://www.france-inflation.com/graphiq ... c-1998.php which illustrates what I said above:

The housing curve is undoubtedly diminished by the rents of tenants and social housing that can not increase in the same way as the coast of real estate buying / selling.

Go there on this site, there are different interesting clues. On the other hand, it is not monetary inflation but price inflation (what are you doing?)

Found this too: https://www.econologie.com/forums/nous-conso ... t8452.html

Here we are talking about consumer products, therefore the INSEE Consumer Price Index = price inflation, do not you think?

BUT the 3 inflations you are talking about are related. "Everything" comes from monetary inflation itself resulting from monetary creation (credit debt, printing money ...) the other 2 are only consequences.

The higher the interest rates, the higher the monetary inflation (and therefore the other 2). Look at the history of 80 years ... interest rates were testing 10% but at the same time people were buying their homes in less than 10 years generally ... almost unthinkable today ...

On the other hand, it is not because a trader raises his prices that he participates in the inflation of the currency, it would be necessary that all do it ... and still not sure that this has lasting consequences. The problem is that a trader rarely drops his prices ... even if the purchase price has dropped. We will soon have a good example in practice with the price of bread, linked to the price of wheat which increases following the Russian fires of the summer. So in the end, as felt by the consumer, it is as if it were monetary inflation.

B) Regarding real estate, if it was really the value of the currency that was falling, then wages and pensions should have increased by the same proportion. Now we have found this recently:

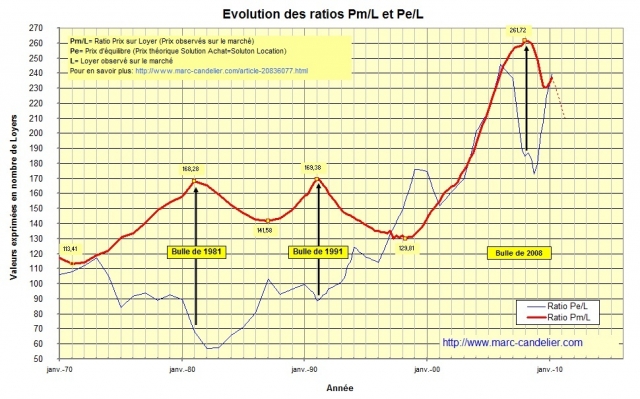

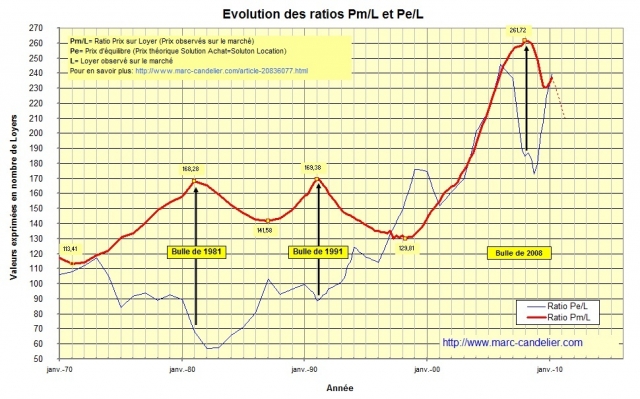

Did you know that in 1958 a dwelling was worth on average 70 rents and that 40 years later, in 1998, it was necessary to spend on average 133 rents to become owner? Did you know that in 2008, at the height of the bubble, a dwelling cost on average 262 rents and that prices were overestimated by 80%?

https://www.econologie.com/forums/la-rentree ... tml#177548

Near 100% increase in 10 years what is it? Surely not a consequence of inflation, it is the foutage mouth of the owners (baby boomers for the most ... we find them ...) ... and unconsciousness (stupidity?) on the part of young couples who buy with 30 or 40 years of credit ...

In practice, look around: any owner who has become so before 2000 has earned more money on the real estate speculation of his property than by saving his labor. This is the kind of thing that should please Xaveco ca

If real estate is not taken into account in the calculation of inflation, it is above all so as not to publicly admit double-digit price inflation ... in times of "real estate crisis" as it has been since 2 years...

C) Regarding the evolution of prices since 98, I found this: http://www.france-inflation.com/graphiq ... c-1998.php which illustrates what I said above:

The housing curve is undoubtedly diminished by the rents of tenants and social housing that can not increase in the same way as the coast of real estate buying / selling.

Go there on this site, there are different interesting clues. On the other hand, it is not monetary inflation but price inflation (what are you doing?)

Found this too: https://www.econologie.com/forums/nous-conso ... t8452.html

0 x

Do a image search or an text search - Netiquette of forum

-

Christophe

- Moderator

- posts: 79360

- Registration: 10/02/03, 14:06

- Location: Greenhouse planet

- x 11060

Obamot wrote:We have recently been forced to return to inflation, we have gone through periods of deflation and a very long period of stagflation. Besides, it is relatively difficult to know in which situation one is exactly.

You speak for whom. Switzerland or Europe?

Ah on the site inflation inflation I found something funny: the impact of the Sale on the CPI since we can see the hollows at the beginning and mid of year (balances of January and summer):

0 x

Do a image search or an text search - Netiquette of forum

Obamot wrote:We have recently been forced to return to inflation, we have gone through periods of deflation and a very long period of stagflation. Besides, it is relatively difficult to know in which situation one is exactly.

What do you think is based on deflation?

Are you talking about total inflation, or only price inflation?

0 x

See you soon !

-

Christophe

- Moderator

- posts: 79360

- Registration: 10/02/03, 14:06

- Location: Greenhouse planet

- x 11060

Subsidiary question: why are economists and politicians so afraid of deflation? Yet synonymous with increased purchasing power for the consumer no?

0 x

Do a image search or an text search - Netiquette of forum

Your previous post is so long and dense that I do not know where to start ...

I'm afraid this deflation refers only to price declines, right?

In general, the decrease in prices corresponds to a decrease in consumption, therefore less credit, and therefore less increase in the money supply.

But if the money supply does not increase enough in the current operation, there is not enough money to repay the loans in progress and the credit capital coming to an end: we are in a pyramid, a ponzi scheme for credits ... and everything falls apart.

Christophe wrote:Subsidiary question: why are economists and politicians so afraid of deflation? Yet synonymous with increased purchasing power for the consumer no?

I'm afraid this deflation refers only to price declines, right?

In general, the decrease in prices corresponds to a decrease in consumption, therefore less credit, and therefore less increase in the money supply.

But if the money supply does not increase enough in the current operation, there is not enough money to repay the loans in progress and the credit capital coming to an end: we are in a pyramid, a ponzi scheme for credits ... and everything falls apart.

0 x

See you soon !

- Obamot

- Econologue expert

- posts: 28725

- Registration: 22/08/09, 22:38

- Location: regio genevesis

- x 5538

All I know is that the dollar against Swiss francs has almost 40% inflation. For the euro it is very difficult to calculate for us, the 80% of our exports are with Germany, which have sales price practices that are not comparable to what is found in France. ..

Don't rely too much on me to take an economics course, you are probably better qualified than me. Inflation is a twisted thing, because it influences the calculation of the GDP, which is the "working tool" for making comparisons from one country to another ... Even at the UN, economists at the Economic Commission for Europe have always been dropped. They strode up and down the hall to do political shenanigans, instead of being in their office trying to see more clearly ... (I could name names ...)

To answer Christophe, I would say that deflation produces the opposite effect of inflation!

And stagflation "would consist of a set of simultaneous phenomena mixing low growth (sometimes slightly negative) with a high degree of inflation.

To come back to my teacher, I think he had a hard time understanding what he was trying to explain himself in class.

Last edited by Obamot the 27 / 09 / 10, 11: 20, 1 edited once.

0 x

-

Christophe

- Moderator

- posts: 79360

- Registration: 10/02/03, 14:06

- Location: Greenhouse planet

- x 11060

bernardd wrote:Your previous post is so long and dense that I do not know where to start ...

Thank you, thank you ... well I spent almost 30 minutes! Start by responding to A) for example ...

bernardd wrote:I'm afraid this deflation refers only to price declines, right?

In general, the decrease in prices corresponds to a decrease in consumption, therefore less credit, and therefore less increase in the money supply.

But if the money supply does not increase enough in the current operation, there is not enough money to repay the loans in progress and the credit capital coming to an end: we are in a pyramid, a ponzi scheme for credits ... and everything falls apart.

- Yes I thought of the price but as for THE inflations, deflations are linked.

- This is the explanation given in https://www.econologie.com/forums/qui-fabriq ... t6273.html but I'm not sure everything would crumble, a healthier system could replace it no?

Last edited by Christophe the 27 / 09 / 10, 12: 10, 1 edited once.

0 x

Do a image search or an text search - Netiquette of forum

- Obamot

- Econologue expert

- posts: 28725

- Registration: 22/08/09, 22:38

- Location: regio genevesis

- x 5538

You are right to put "plurals", Inflationsdeflationsstagflations... These are trends so it's difficult to "frame". As an example, it would be necessary to dissect "derivative products" such as subprimes and determine what real effects they had at the time to give a correct explanation of what was happening before the 2008 crack (nobody did it except a few insiders, reason why the bubble exploded). In fact, we know the mechanisms that lead to the bubble well ... And we know that the phenomenon will (re) appear in one form or another.

There is only hyperinflation that can be well framed, because it is a caricature situation.

There is only hyperinflation that can be well framed, because it is a caricature situation.

Last edited by Obamot the 27 / 09 / 10, 11: 34, 1 edited once.

0 x

Obamot wrote:All I know is that the dollar against Swiss francs has almost 40% inflation.

If we start to talk about the relationships between different currencies, it becomes even more complicated! The long-run relationships between currencies are basically related to comparisons between the monetary inflation ratio and the corresponding "sustainable" GDPs.

But time lags and political opportunities come to shake things up in the short term ...

0 x

See you soon !

-

- Similar topics

- Replies

- views

- Last message

-

- 27 Replies

- 26665 views

-

Last message by Obamot

View the latest post

24/12/22, 13:58A subject posted in the forum : Economy and finance, sustainability, growth, GDP, ecological tax systems

Back to "Economy and finance, sustainability, growth, GDP, ecological tax systems"

Who is online ?

Users browsing this forum : No registered users and 145 guests