social charges are unfair, everyone admits!

to make pay the unemployment health insurance and the retirement to the rare employee who still work, even in the disaster

vat seems a good way to make everyone pay, but wrong good idea

he who has a low income spends everything and spares nothing, he pays VAT on everything

he who has a big income saves a lot: he only pays vat on what he spends right away, for what he saves he will pay later, or never if he travels and spends abroad

vat is therefore an anti progressive tax which makes the poor pay more, the 2 vat rates do nothing even the low income pay the same proportion of stuff at 19.6

you have to look for a broader base for social charges but better than vat: the income tax seems to me the best: the one that the state can adapt most easily to the evolution of the situation, if there are income which escape the income tax there is only to make the modifications which it is necessary

the vat is an automatic thing impossible to modulate, which deprives the state of being able to tax less what it wants to encourage or to tax more what it wants to curb

the vat was invented in france in 1954 and generalized by giscard: sad invention copied by all of europe and part of the world

For or against the social VAT?

- chatelot16

- Econologue expert

- posts: 6960

- Registration: 11/11/07, 17:33

- Location: Angouleme

- x 264

chatelot16 wrote:he who has a low income spends everything and spares nothing, he pays VAT on everything

False, he manages, he buys second-hand, he recovers, he exchanges: the real way of doing things for just a few million years ...

whoever has a large income does not receive it in the form of wages, or else receives it abroad: he pays neither social charges on wages, nor taxes in France on income.

chatelot16 wrote:he who has a big income saves a lot: he only pays vat on what he spends right away, for what he saves he will pay later, or never if he travels and spends abroad

If he is in France, he pays in France.

chatelot16 wrote:the vat is an automatic thing impossible to modulate, which deprives the state of being able to tax less what it wants to encourage or to tax more what it wants to curb

Especially not ! It is even an advantage of VAT to avoid the possibility of influence or bribes to favor this or that passing fad.

If there is to be a brake, it must be explicit: vote on a law.

Another advantage of VAT is that it is not intrusive on privacy.

But the fairest thing is to distribute the income from money creation among all citizens: today, banks and their owners share a minimum income of several hundred billion euros, without any justification.

It is not a question of going to tax this: it is just necessary to distribute it at the source.

0 x

See you soon !

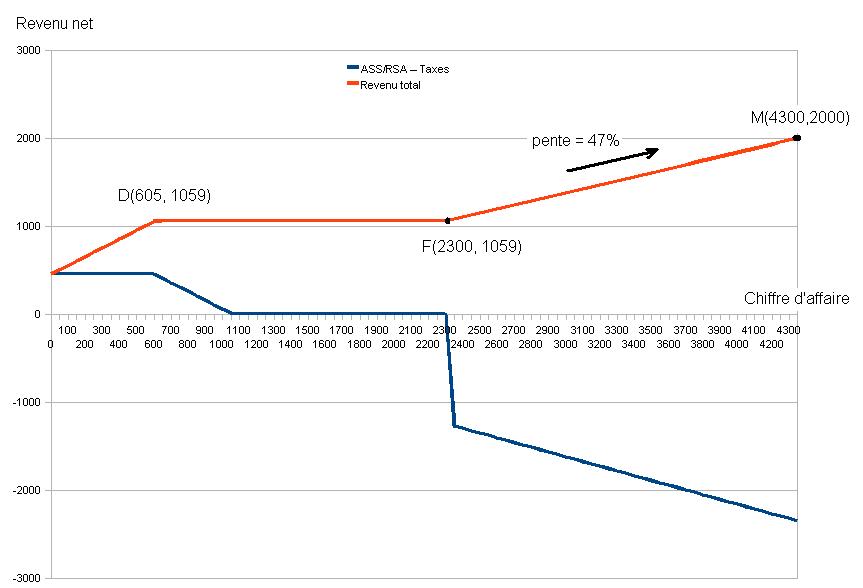

For those who think that income tax is fairer than VAT, do this little exercise:

Work more to earn more

The result: what is called "the great ditch":

With income taxes, all salary gains between € 605 per month and € 2300 per month go into payroll taxes.

At least, with VAT, it's proportional.

And this also applies to the self-employed, who are also the wealthiest.

Work more to earn more

The result: what is called "the great ditch":

The Grand Fossé is therefore between € 605 / month and € 2300 / month in turnover, where you always earn the same thing around € 1100 / month.

With income taxes, all salary gains between € 605 per month and € 2300 per month go into payroll taxes.

At least, with VAT, it's proportional.

And this also applies to the self-employed, who are also the wealthiest.

0 x

See you soon !

- Philippe Schutt

- Econologue expert

- posts: 1611

- Registration: 25/12/05, 18:03

- Location: Alsace

- x 33

chatelot16 wrote: low income pay the same proportion of stuff at 19.6

This would tend to prove that low incomes are far above the subsistence minimum. In short, let the poor cry with their mouths full.

chatelot16 wrote:you have to look for a broader base for social charges but better than vat: the income tax seems to me the best: the one that the state can adapt most easily to the evolution of the situation, if there are income which escape the income tax there is only to make the modifications which it is necessary

the vat is an automatic thing impossible to modulate, which deprives the state of being able to tax less what it wants to encourage or to tax more what it wants to curb

the vat was invented in france in 1954 and generalized by giscard: sad invention copied by all of europe and part of the world

Having a heavy tax leads to fraud. it is better to have several light taxes, it hurts less ...

bernardd wrote:For those who think that income tax is fairer than VAT, .........

We know that the income tax is used for redistributive purposes. It seems to me that a majority agrees.

bernardd wrote:I don't see the link between higher wages and the looting of natural resources.

If the salary is high, the resource is proportionately cheap, and the manufacturing will save labor even if it consumes more resources. Or we would rather throw away and remanufacture than repair.

On the contrary, with low wages, the resource is expensive and we save it to the max.

bernardd wrote:A simple mathematical proof is true or false.

Nothing seen that looks like a demonstration of this theory, but a critique of the existing system and an argument for theirs.

bernardd wrote:Yes, but this is already the current situation in the euro zone since 1997, you can check on the ECB data: therefore no change in the rate.

Because the euro is stored by foreign countries. This obliges to compensate. Otherwise, we should be under 2%

bernardd wrote:Sorry, I don't understand how extreme this would be, can you explain? What is contraband and clandestine work doing? and why should we leave europe? I seem to have missed a step in your reasoning.

Extreme by the final VAT rate. So high that it will encourage you to avoid it. Contraband and moonlighting being the 2 most widespread methods. Such a disparity will be incompatible with the taxation of our neighbors.

cool. I know some who will immediately vote for you as president;)bernardd wrote:As for the lazy, they are more the result of an illness than of a will.

It seems to me that such a high VAT rate would greatly reduce international trade. We can be for, but I would rather be for moderation which implies being satisfied with a band-aid at least at first.

0 x

Philippe Schutt wrote:bernardd wrote:For those who think that income tax is fairer than VAT, .........

We know that the income tax is used for redistributive purposes. It seems to me that a majority agrees.

If you take the link I gave (Work more to earn more), you will see firsthand that income tax is not progressive, but on the contrary heavier on low income: it is not redistributor, especially since only certain incomes are subject to it.

In this sense, VAT has at least a fixed rate, which is already better distributed.

And when the taxes are used to finance industrial projects with private shareholders, where is the redistribution?

When to say that a majority agrees, that remains to be proven: it is clear that the current representatives of the people are not representative of the people.

Philippe Schutt wrote:bernardd wrote:I don't see the link between higher wages and the looting of natural resources.

If the salary is high, the resource is proportionately cheap, and the manufacturing will save labor even if it consumes more resources. Or we would rather throw away and remanufacture than repair.

On the contrary, with low wages, the resource is expensive and we save it to the max.

To my knowledge, this feedback mechanism has not been demonstrated. Do you have sources

In history, I have mainly seen as the main mechanism bribes to the leaders of poor countries rich in natural resources, or political and military intervention when the currency is not enough to corrupt.

In addition, with the real social VAT (net salary = gross salary = company wage cost) it is not so much wages which increase as undue deductions which decrease.

Philippe Schutt wrote:bernardd wrote:A simple mathematical proof is true or false.

Nothing seen that looks like a demonstration of this theory, but a critique of the existing system and an argument for theirs.

You must have missed the Universal Dividend Solution page 29 to 42, which shows that the equal distribution between humans over time, that is to say the equal treatment before a common currency, implies a monetary creation between 5 and 10%.

Philippe Schutt wrote:bernardd wrote:Yes, but this is already the current situation in the euro zone since 1997, you can check on the ECB data: therefore no change in the rate.

Because the euro is stored by foreign countries. This obliges to compensate. Otherwise, we should be under 2%

No, the monetary creation of the € uro is only achieved by the credit of private banks. And this creation has been visible on the ECB's website since at least 1997 as well as the outstanding loans.

Since 1997, monetary inflation has averaged between 7% and 8% per year, with a decline in 2008 and 2009, because new credits are scarce and this is what jeopardizes the repayments of existing credits, because the monetary system is a pyramid scheme; the new credits are just used to pay the interest on current loans and the principal of term loans.

To have real inflation, price inflation must be added to monetary inflation, ie around 10% per year since 1997, we had calculated it on another thread that I forgot, sorry.

Philippe Schutt wrote:bernardd wrote:Sorry, I don't understand how extreme this would be, can you explain? What is contraband and clandestine work doing? and why should we leave europe? I seem to have missed a step in your reasoning.

Extreme by the final VAT rate. So high that it will encourage you to avoid it. Contraband and moonlighting being the 2 most widespread methods. Such a disparity will be incompatible with the taxation of our neighbors.

The real social VAT (net salary = gross salary = cost of enterprise) removes the concept of clandestine work: without charges to be paid, moonlighting has no meaning.

However, barter will increase if other government spending is not better managed.

Philippe Schutt wrote:cool. I know some who will immediately vote for you as president;)bernardd wrote:As for the lazy, they are more the result of an illness than of a will.

It is not the salary that motivates the work, on the contrary. Do you know the studies cited in this presentation?

Universal income, future or utopia?

Philippe Schutt wrote:It seems to me that such a high VAT rate would greatly reduce international trade. We can be for, but I would rather be for moderation which implies being satisfied with a band-aid at least at first.

What do you rely on to assert this? Because precisely exports are excluding VAT, VAT is added only to imports.

So the exports of all countries become comparable, outside the national choices of social regime.

0 x

See you soon !

- Philippe Schutt

- Econologue expert

- posts: 1611

- Registration: 25/12/05, 18:03

- Location: Alsace

- x 33

bernardd wrote:If you take the link I gave (Work more to earn more), you will see firsthand that income tax is not progressive, but on the contrary heavier on low income: it is not redistributor, especially since only certain incomes are subject to it.

well no, the blue curve shows what the state is taking you, hence the negative sign

bernardd wrote:

When to say that a majority agrees, that remains to be proven: it is clear that the current representatives of the people are not representative of the people.

Being voted, they are necessarily or at least were at the time of the vote, which is not so old ...

It is the elasticity of substitution. See the texts of neo-classical economists.bernardd wrote:Philippe Schutt wrote:If the salary is high, the resource is proportionately cheap, and the manufacturing will save labor even if it consumes more resources. Or we would rather throw away and remanufacture than repair.

On the contrary, with low wages, the resource is expensive and we save it to the max.

To my knowledge, this feedback mechanism has not been demonstrated. Do you have sources

for example, cars are quickly thrown away in France and repaired ad eternam in Africa.

It arbitrarily fixes the level of the function f (c) at 0.98.bernardd wrote:You must have missed the Universal Dividend Solution page 29 to 42, which shows that the equal distribution between humans over time, that is to say the equal treatment before a common currency, implies a monetary creation between 5 and 10%.

I repeat, a little differently. Monetary inflation is necessary to avoid a shortage of money, as countries like China have started to store both the euro and the dollars. However, the currency does not lose its value because the money supply in circulation does not increase so much. It would be different if these countries destocked their euros.bernardd wrote:Philippe Schutt wrote:bernardd wrote:Yes, but this is already the current situation in the euro zone since 1997, you can check on the ECB data: therefore no change in the rate.

Because the euro is stored by foreign countries. This obliges to compensate. Otherwise, we should be under 2%

No, the monetary creation of the € uro is only achieved by the credit of private banks. And this creation has been visible on the ECB's website since at least 1997 as well as the outstanding loans.

Since 1997, monetary inflation has averaged between 7% and 8% per year, with a decline in 2008 and 2009, because new credits are scarce and this is what jeopardizes the repayments of existing credits, because the monetary system is a pyramid scheme; the new credits are just used to pay the interest on current loans and the principal of term loans.

To have real inflation, price inflation must be added to monetary inflation, ie around 10% per year since 1997, we had calculated it on another thread that I forgot, sorry.

With a VAT close to 50% I guarantee you that many will want to buy "excluding VAT"bernardd wrote:The real social VAT (net salary = gross salary = cost of enterprise) removes the concept of clandestine work: without charges to be paid, moonlighting has no meaning.

bernardd wrote:Philippe Schutt wrote:It seems to me that such a high VAT rate would greatly reduce international trade. We can be for, but I would rather be for moderation which implies being satisfied with a band-aid at least at first.

What do you rely on to assert this? Because precisely exports are excluding VAT, VAT is added only to imports.

So the exports of all countries become comparable, outside the national choices of social regime.

precisely, for an equivalent level of social protection, countries which do not adopt such a vat would be strongly disadvantaged. At a minimum, all of Europe should adopt this social VAT. But we have the most expensive system, we have the most interest in practicing it. And it is exactly the opposite for countries with low protection or with private protection.

0 x

-

Christophe

- Moderator

- posts: 79318

- Registration: 10/02/03, 14:06

- Location: Greenhouse planet

- x 11040

Latest government filth: diverting the idea of social VAT to inflate VAT to finally "reimburse" the debt ... and satisfy a few bankers who rule the world ...

http://www.francetv.fr/info/xavier-bert ... 45463.html

And those who think that social VAT will only affect imported products have understood nothing ... VAT is applied on ALL (except niche or non-subject schemes) margins and commercial transactions ... except bank transactions.

And the circle is complete ...

Explanations on how VAT works: https://www.econologie.com/forums/fonctionne ... 10068.html

http://www.francetv.fr/info/xavier-bert ... 45463.html

Social VAT implemented "before the presidential election"

Social VAT will be done well "before the presidential election". Valérie Pécresse assured it on Tuesday January 3 on France Info. The Budget Minister and government spokesperson said that its principle would be debated at the social summit set for January 18 at the Elysee Palace.

The principle of social VAT, also called "anti-delocalization VAT" and strongly criticized by the opposition, would consist in reducing employee and employer charges to transfer them to VAT, increased by several points.

"Too many loads on work in France"

A little earlier, Tuesday, Xavier Bertrand, Minister of Labor, had indicated on France 2 that this social VAT, to which Nicolas Sarkozy alluded during his wishes of December 31, would be put in place, without specifying a timetable.

It is "in the general interest to lower the charges on labor", he said, arguing that there are "too many charges on labor in France". And to cite as an example Germany, where, for 100 euros of gross salary, the charges are 39 euros, against 50 euros in France.

And those who think that social VAT will only affect imported products have understood nothing ... VAT is applied on ALL (except niche or non-subject schemes) margins and commercial transactions ... except bank transactions.

And the circle is complete ...

Explanations on how VAT works: https://www.econologie.com/forums/fonctionne ... 10068.html

0 x

Do a image search or an text search - Netiquette of forum

Christophe wrote:And those who think that social VAT will only affect imported products have understood nothing ... VAT is applied on ALL (except niche or non-subject schemes) margins and commercial transactions ... except bank transactions.

Of course, VAT does not only affect imports.

The idea is simply to make the charges (which weigh today on wages) weigh on all consumption, therefore _also_ on imported products.

Today the annuitant hardly pays any social charges. With social VAT he will pay it.

Lowering the burdens on work to transfer them to consumption can only be positive.

I was of this opinion a long time ago, and I still am

0 x

Solar Production + VE + VAE = short cycle electricity

- sen-no-sen

- Econologue expert

- posts: 6856

- Registration: 11/06/09, 13:08

- Location: High Beaujolais.

- x 749

indy49 wrote:Today the annuitant hardly pays any social charges. With social VAT he will pay it.

Lowering the burdens on work to transfer them to consumption can only be positive.

I was of this opinion a long time ago, and I still am

... It is above all a nice stroke of the sword in the water, which will affect as usual the most modest households, to repay debts that are impossible to settle and make the rich even richer!

0 x

"Engineering is sometimes about knowing when to stop" Charles De Gaulle.

-

- Similar topics

- Replies

- views

- Last message

-

- 0 Replies

- 5400 views

-

Last message by Exnihiloest

View the latest post

07/03/22, 15:44A subject posted in the forum : Economy and finance, sustainability, growth, GDP, ecological tax systems

-

- 63 Replies

- 12046 views

-

Last message by GuyGadeboisTheBack

View the latest post

14/01/22, 18:00A subject posted in the forum : Economy and finance, sustainability, growth, GDP, ecological tax systems

-

- 50 Replies

- 11764 views

-

Last message by Janic

View the latest post

01/09/21, 10:26A subject posted in the forum : Economy and finance, sustainability, growth, GDP, ecological tax systems

-

- 1 Replies

- 2987 views

-

Last message by Christophe

View the latest post

07/07/21, 12:45A subject posted in the forum : Economy and finance, sustainability, growth, GDP, ecological tax systems

-

- 0 Replies

- 6697 views

-

Last message by Christophe

View the latest post

02/07/21, 11:43A subject posted in the forum : Economy and finance, sustainability, growth, GDP, ecological tax systems

Back to "Economy and finance, sustainability, growth, GDP, ecological tax systems"

Who is online ?

Users browsing this forum : Google Adsense [Bot] and 162 guests